Class 3: A Type of Special Occupational Tax (SOT)

Type 01 FFL: A Type of Federal Firearms License authorizing the licensee to deal

in firearms, including firearms regulated under the National Firearms Act (NFA)

The terms above should be clarified because when misapplied, lead people to believe false information to be correct. Especially people who want to become dealers in NFA firearms. Many times, applicants for a FFL believe that a separate license is required to deal in NFA firearms, which is not the case. The issue is not complicated at all, however since the term “Class 3 license” gets repeated over and over again, people start believing that it’s a distinct license. So, as of this writing, no one can get a “Class 3 License”. It’s like this: a person who imports NFA firearms would have a Type 08 or 11 FFL and pay a “Class 1” Special Occupational Tax (SOT); but does not possess a “Class 1 License” (27 CFR §479.32). So a person who is a dealer in NFA firearms would have a Type 01 FFL, and pay a Class 3 SOT; simple right.

Contact us for a free consultation and find out

how we can help you find your way through

the bureaucracy and get your FFL, including Class 3

S.O.T.

786-587-8827

Info@FFLConsultingGroup.com

Class 3 License / Class 3 FFL…Why you’ll never get either of these?…They don’t exist.

It’s important for people who are seeking to be licensed as FFLs and would like to deal, import or manufacture firearms regulated under the National Firearms Act (NFA) to understand precisely what “Type” of license is required, and what additional requirements exist. Using terms that don’t appear in the law or in regulations tend to confuse people who are not very familiar with these processes. Confusion leads to wasted time, money and energy. So we should try and be as accurate as possible with terminology.

Yes, I know it sounds like I’m nitpicking right? Maybe, but we should be clear about these terms and the way they’re used in order to avoid miscommunication, misunderstanding and confusion. The term “Class 3 License” does not appear anywhere in the law or the regulations that I’m aware of. If it does appear on some official ATF documentation, please let us know by leaving a message or contacting research@fflconsultinggroup.com.

Using and understanding the correct terminology in this case goes a long way in saving you time and money!

Getting An FFL? Don’t be Confused By Jargon.

It’s understandable if people generally use the term, because it seems to be used a lot. If it’s fitting for you to use in your business, and you find it’s okay among your circles, why not use it? But you should also understand that it’s really just jargon that can create confusion, and is misleading in some cases, especially for persons who are trying to get into the firearms business, get properly licensed, and get adequate guidance. Current and prospective FFLs should be cautious and understand that there is no license called a “Class 3” that is required to conduct business as a dealer in NFA firearms.

This is What You Need To Deal in NFA Firearms

If you are already licensed: There is a Special Occupational Tax (SOT) that must be paid, a form that must be filled out (see below) and a SOT Stamp that must be in your possession (See Title 26 U.S.C., Chapter 53, Internal Revenue Code §5801 (a)(2). Understanding this simple fact could save your business money, time and aggravation.

Always Ask The Magic Question: What’s The Reference?

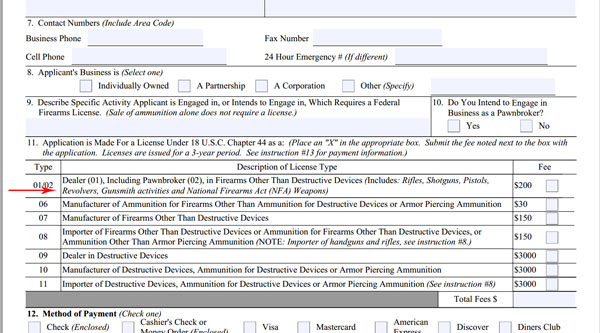

In case you were wondering: As you can see in Item 11 on the ATF Form 7 (Application for a Federal Firearms License), the Type 01/02 License “(Includes:…National Firearms Act (NFA) (Weapons)“.

Federal Firearms License Veteran’s Service

This is a Service – Not a FFL kit.

Free Consultation from a former ATF Investigator – 12 Years with ATF

Disabled Vets may qualify for free services

Call Direct: 786-587-8827

What is SOT?

The definition and reasons for the payment of SOT are complicated. For our purposes, the SOT is a tax that must be paid by FFLs who engage in the dealing, importation or manufacturing of NFA firearms. The tax is paid using ATF Form 5630.7 Special Tax Registration and Return. Once the tax is paid, the FFL will receive a “Special Tax Stamp” ATF F 5630.6a. This document is evidence that the FFL has paid the required tax.

What If I’m Already Licensed?

The SOT payment may be made by a person already licensed, giving that person the ability to engage in dealing, manufacture, or importation of NFA firearms as applicable. File ATF F 5630.7 and contact the NFA Branch for additional guidance. The SOT can be paid in conjunction with a new application for a FFL as well. See Item 9 from the ATF Form 7 Instructions.

How To Qualify to Deal in NFA Firearms: A Very Brief Brief…

1) Apply for a Federal Firearms License (FFL)

2)Pay the Special Occupational Tax (SOT) (Class 3 for Dealers) using the proper form as indicated above.

3) Maintain a current SOT by paying your applicable tax yearly.

Of course these 3 steps are broad. Ensure you follow the directives found here, and ensure you read and follow the instructions on the forms themselves.

When you are inspected by ATF, the investigator will likely require you to produce the current tax stamp. If you are engaged in the business of dealing in NFA firearms, you must pay the SOT.

©2014 – 2019 Firearms Licensing and Consulting Group LLC, FFL Consulting Group, FFLConsultinggroup.com All Rights Reserved. See “legal” section for privacy policy.

*We do not share this information with a third party. See our Privacy and Legal policies linked above.